Over half of Americans, around 52%, say they’re living paycheck to paycheck, a figure that has remained stubbornly high throughout the year. Others put that number even higher, at 61% according to LendiyngClub, and a staggering 29% of Gen Z workers fall into that group.

Rent is rising, groceries are getting pricier, and building savings is still a slog. Meanwhile, hourly wage earners today believe that on-demand pay could finally help them get some breathing room between paychecks.

That’s where apps like Earnin come in, offering a way to tap into your own earned wages before payday. The fintech market is growing at a very fast pace, and collaborating with the app development agency is a great approach to pursue.

In this blog, we’re diving into the best alternatives to Earnin, the apps that help you take control of your cash flow, avoid debt traps, and stop stressing about the next direct deposit. If you’re looking for higher cash advance limits, built-in budgeting tools, or just fewer fees, there’s an app out there built to work for your lifestyle.

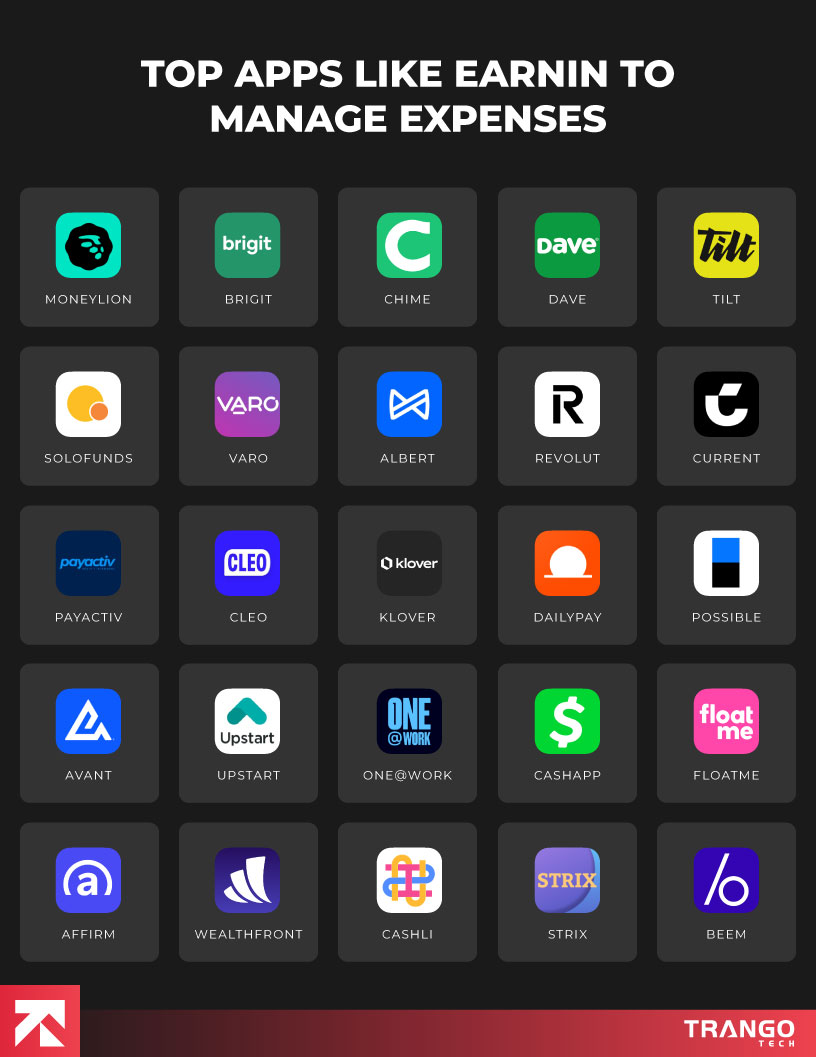

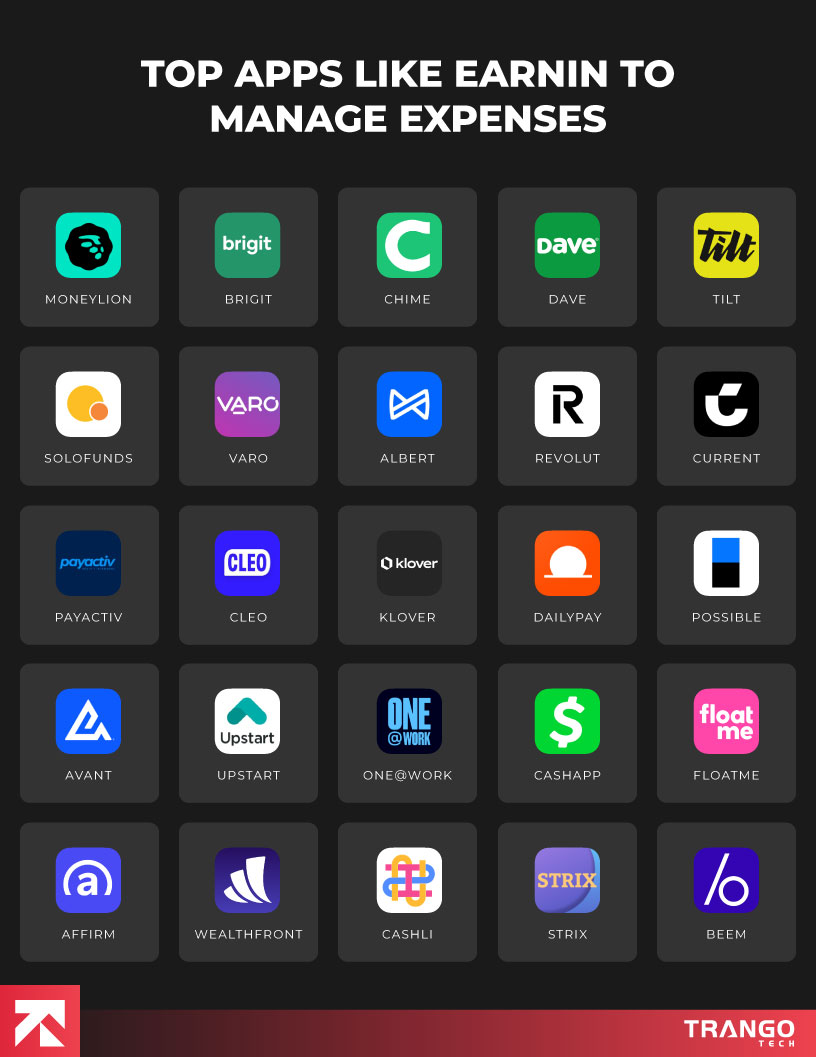

Top 25 Apps Like Earnin to Manage Your Finances

Apps like Earnin are changing the rules of payday and putting control back in your hands. The key is finding the right fit for your lifestyle. Here are the best alternatives you need to check out:

1. MoneyLion

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.8/5

MoneyLion is an all-in-one fintech app that offers mobile banking, investing, and credit tools. Its InstaCash feature allows you to borrow money quickly up to $500, and a great option for those who need a short-term cash boost.

The app supports instant transfers, allowing you to receive funds in your account instantly when you need them. Just note that this convenience comes with a small fee.

| Pros |

Cons |

| No interest or hidden fees |

Instant transfers have a fee |

| No credit check required |

Eligible based on your income and account activity |

| Get a loan up to $1,000 |

Repayment auto-deducted on payday |

Key Features

MoneyLion is one of the popular apps similar to Earnin that goes beyond cash advances with an impressive range of functionalities:

RoarMoney Banking

This feature offers early direct deposit up to two days earlier. It also has features like budgeting tools and automatic round-up savings.

Cashback and Loyalty Points

You can earn cashback on daily purchases and receive bonuses from select merchants and brand partners.

Investing and Crypto

You can start investing with as little as $5 in diversified portfolios. Want to try crypto? You can buy and sell Bitcoin and other cryptocurrencies directly through the app.

AI-Powered Financial Coaching

This feature lets you control your finances with smart tools, assisting you in tracking spending, setting saving goals, improving your credit score, and reducing debt.

Identity Theft Protection

Your personal data is monitored around the clock with 24/7 fraud alerts, dark web surveillance, and other protections to keep your financial identity safe.

Requires

Android 6.0 or up, iOS 12.4 or up

Size

324 MB Android, 251 MB iOS

2. Brigit

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.8/5

Brigit is one of the popular instant payday apps that helps you avoid financial setbacks before they happen. Once connected to your bank account, the app monitors your balance and can automatically send a cash advance if you’re about to overdraft.

If you’re someone who regularly struggles with overdraft fees, inconsistent budgeting, or just wants a more proactive approach to money management, Brigit is an excellent option. Looking for more options? You can check out our blog that enlist top apps like Brigit.

| Pros |

Cons |

| Ideal for users with low or no credit scores |

A monthly subscription is required |

| Get a loan amount up to $250 |

Eligible based on your income and account activity |

| Repayment plans are flexible and easier to manage |

Repayment auto-deducted on payday |

Key Features

Brigit can be worth it for users who want continuous protection and smart money tools:

Automatic Overdraft Protection

Brigit automatically detects when your balance is getting low and deposits funds to help you avoid overdraft fees. You can also set custom alerts to get notified before your account runs dry.

Flexible Repayment Scheduling

This feature allows you to align your repayment schedule with your income cycle. Repayments are deducted automatically, so you don’t have to worry about missing a payment.

Credit Builder Program

The app helps you build your credit by reporting on-time payments to major credit bureaus, without taking on new debt or paying interest. It’s a safe, low-risk way to improve your credit score.

Secure and Private

The Brigit app entails 256-bit encryption and two-factor authentication, ensuring your financial data stays safe and secure.

Requires

Android 6.0 or up, iOS 12.4 or up

Size

83 MB Android, 97 MB iOS

3. Chime

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.8/5

Chime is a modern digital banking app that is FDIC-insured with partners like The Bancorp Bank, N.A., and Stride Bank, N.A. It is one of the most trusted alternatives to payday loan apps like Possible Finance.

It eliminates traditional banking fees and empowers users to take control of their financial journey with tools designed for everyday banking and credit building.

| Pros |

Cons |

| Get up to $200 in fee-free overdrafts for debit card purchases and ATM withdrawals |

External account transfers come with a small fee |

| Helps users build credit without a credit check or interest charges |

Limited to only mobile and online banking |

| Deposits are insured up to $250,000 through partner banks |

|

Key Features

Here are some of the essential features that make the Chime app stand out:

SpotMe Overdraft Protection

This feature lets eligible users overdraft up to $200 with no overdraft fees. This applies to debit card purchases and ATM withdrawals, offering a safety net when your balance runs low.

Early Direct Deposit

It helps you get paid two days early. As soon as your employer’s payroll submits the deposit, you’ll have access to your funds.

Credit Builder Program

Chime’s credit builder visa credit card helps you build credit responsibly with no annual fees or credit checks. It reports to all three major credit bureaus.

Automatic Savings

This feature helps you grow your savings with features like round-up transactions and auto-transfer to savings.

Notifications and Alerts

You can stay updated with instant alerts for transactions, deposits, and account activity. This helps you avoid surprises and manage your finances in real-time.

Requires

8.0 and Up (Android), 14.0 and Later (iOS)

Size

186.5 MB (Android), 195.5 MB (iOS)

4. Dave

Google Play Store Rating: 4.4/5

Apple Store Rating: 4.8/5

Dave is a trusted alternative to traditional payday lenders, offering interest-free cash advances of up to $500. It doesn’t trap you in a cycle of debt. Instead, Dave app promotes financial wellness through transparent features, low fees, and smart insights.

While it comes with minor fees and requirements, the combination of budgeting tools, credit-friendly practices, and income-boosting features makes Dave a powerful all-in-one money management app. For more loan app options, you can check out our blog that covers popular apps like Dave in the USA.

| Pros |

Cons |

| Access funds without affecting your credit score |

Instant cash access comes with a small Express Pay fee |

| Gives you an alert before your account goes negative |

Need a consistent income flow to qualify for a higher advance amount |

| Find income-boosting features in one app |

Limited to one advance at a time |

Key Features

Under the hood, there are core features that power the app’s performance. Here’s what the Dave app contains:

Side Hustle Finder

Dave’s side hustle tool connects you to local and remote gig opportunities. This feature matches side jobs based on your skill set, availability, and location.

Credit-Building Tool

It helps you build better financial habits. Dave app tracks spending patterns, offers improvement suggestions, and helps you avoid negative banking behaviors that harm your credit.

Smart Financial Insights

This feature uses AI to analyze your bank activity and provide actionable insights. It tracks recurring bills, detects surprise expenses, and predicts when you might run out of funds.

Goal-Based Savings

You can set up personalized savings goals for things like travel, emergencies, or large purchases. The app transfers small amounts automatically based on your spending behavior.

Automatic Budgeting

Dave creates a budget by syncing with your bank account. It monitors your income and expenses, then sends alerts if your balance is running low or bills are coming due.

Requires

Android 9 or up, iOS 13.0 or up

Size

200 MB Android, 165 MB iOS

5. Tilt (Formerly Empower)

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.8/5

Tilt is one of the leading cash advance apps like Earnin that offers cash advances, based on your current income and spending habits. The app partners with employers to offer interest-free advances and financial tools directly through payroll integration.

Their target is centered around eliminating financial barriers that often plague low to middle-income earners. Additionally, the platform emphasizes confidentiality, allowing employees to access financial assistance without involving their HR departments directly.

| Pros |

Cons |

| No interest or late fees on cash advances |

Applies a $8/month subscription after trial |

| Offers multiple financial tools |

Limited geographical presence in the US |

| Get cash advances up to $500 |

Limited customer support and protection features |

Key Features

Looking for the top wage access app alternatives? Below are the following standout features that make Tilt different from traditional loan apps:

Instant Earned Wage Access

Tilt allows employees to access a portion of their earned but unpaid wages before payday. This feature helps users avoid high-interest loans, overdraft fees, or financial stress during emergencies.

Interest-Free Advances

This feature allows employees to repay the amount through automatic payroll deductions on their next paycheck, making it a transparent and predictable system.

Employer-Payroll Integration

Tilt smoothly integrates with employer payroll systems, ensuring that transactions are secure, automated, and do not require manual intervention from employees or HR teams.

Confidential and Discreet Support

Users can access financial assistance confidentially, without notifying their managers or the HR department. This preserves dignity while offering much-needed support in private.

Financial Health Tools

Tilt offers budgeting tools, personalized insights, and educational resources to help users develop better money habits and achieve long-term financial stability.

Personalized Advance Limits

Employers can set and adjust the amount of advance employees can request, offering flexibility based on company policy and employee needs.

Requires

Android 6.0 or up, iOS 15.0 or up

Size

79 MB Android, 117 MB iOS

6. SoLo Funds

Google Play Store Rating: 4.0/5

Apple Store Rating: 4.3/5

SoLo Funds is a micro-lending platform that connects borrowers with everyday lenders rather than traditional banks. Borrowers can request short-term loans (typically between $20 and $575) on the “Marketplace,” and community members decide whether to fund them.

Approval depends on your SoLo Score, which reflects your banking history, repayment patterns, and overall financial behavior.

| Pros |

Cons |

| Loans are funded within 20 minutes |

Only 55% of loan requests are funded |

| Instead of interest, voluntary tips are used |

Few reports regarding slow response time |

| On-time repayments may be reported to credit bureaus |

|

Key Features

Let’s explore the key features that make the Chime app one of the favorite sites like Earnin:

Peer-to-Peer Borrowing and Lending

This feature connects borrowers directly with individual lenders, eliminating the need for traditional banks or payday lenders.

Credit-Free Access

There are no minimum credit score requirements, making it accessible to individuals with little or no credit history.

Community-Driven Platform

This feature operates on a trust-based model where lenders and borrowers mutually benefit, encouraging a supporting lending ecosystem.

Transparent Terms

All borrowing terms, repayment dates, and agreed-upon interest rates are clearly outlined before accepting a loan, with no hidden fees.

Automated Repayment

SoLo Funds ensures timely repayments through linked bank accounts and reduces the chance of missed payments.

Requires

Android 8.0 or up, iOS 15.0 or up

Size

55 MB Android, 85 MB iOS

7. Varo

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.9/5

Varo is one of the popular sites like Earnin that offers services like savings accounts, checking accounts, and personal loans. The company is FDIC-insured, meaning the funds in your Varo account are protected. It gives you the financial freedom to handle unexpected expenses without falling into debt traps.

Varo became the first consumer fintech in the United States to receive a national bank charter from the Office of the Comptroller of the Currency (OCC) in 2020. So, if you want to avoid hidden fees and overdraft penalties, Varo is a great option to consider.

| Pros |

Cons |

| Fee-free checking account with no minimum balance requirements |

Eligibility for cash advances is quite stringent |

| Earn 5% APY on a savings account for balances up to $5,000 |

Cash advance amount doesn’t cover large expenses |

| Bank accounts do not require a credit check |

|

Key Features

There are some of the known features that make the Varo app truly shine in the industry:

High-Yield Savings Account

Varo offers a competitive high-yield savings account with an APY of up to 5%. This allows customers to grow their savings faster without any risky investments.

Varo Advance

Customers can borrow up to $250 instantly through the Varo Advance feature. This provides a quick cash solution in emergencies without going to payday lenders.

Financial Inclusion Focus

This feature caters to underserved communities, offering accessible banking features without the barriers of traditional banking systems.

Transaction Alerts

Varo’s mobile app sends instant transaction notifications, so customers always know when money is being deposited or withdrawn.

Requires

Android 9 and up, iOS 15.1 or up

Size

112 MB Android, 86 MB iOS

8. Albert

Google Play Store Rating: 4.5/5

Apple Store Rating: 4.6/5

Albert is one of the great money apps like Earnin that helps users save money, track expenses, invest, and get instant cash advances when needed. Unlike many traditional lending platforms, Albert focuses on holistic financial health, offering cash advances of up to $250 without interest, late fees, or mandatory credit checks.

Alongside cash advances, Albert also offers personalized financial advice through its “Genius” service, which connects users with real human experts. The app’s focus is on financial wellness, offering tools to track spending, save automatically, and invest in personalized portfolios.

| Pros |

Cons |

| Doesn’t require a hard credit inquiry, making it accessible for users with no credit history |

Not a great option for larger emergencies |

| Instant delivery to the Albert debit card and same-day bank transfers are available |

Instant access can incur fees unless you use the Albert card |

| Find comprehensive financial tools like budgeting, savings, automation, and investment |

Not all users are eligible for the maximum advance amount |

Key Features

The Albert app has the following key features that help you budget smarter and save effortlessly:

Automated Savings

Albert analyzes your spending habits and automatically transfers small amounts into your savings account.

Genius Financial Guidance

Subscribers get access to real human experts who provide personalized advice on budgeting, saving, debt, payoff, and investments.

Early Paycheck Access

Direct deposit users can receive their paychecks up to two days earlier than those with traditional bank accounts.

Automatic Bill Negotiation

This feature helps you lower bills (like phone or internet) by negotiating directly with providers, saving you extra money.

Secure and FDIC-Insured

Albert accounts are protected with encryption and FDIC-insured up to $250,000.

Requires

Android 7.0 and up, iOS 13.4 or up

Size

135 MB Android, 134 MB iOS

9. Revolut

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.7/5

Revolut is a reputable lending platform that helps users apply for a loan, receive approval in seconds, and have the funds deposited directly into their Revolut account. Loan offers are personalized using Revolut’s smart credit assessment technology, ensuring competitive interest rates based on your credit profile.

There are no hidden fees, and you can repay early at any time without penalties, helping you save on interest.

| Pros |

Cons |

| Borrow up to $20,000 within a quick turnaround time |

Rates can be higher for users with low credit scores |

| Interest rates are clearly displayed before acceptance |

Requires a high borrowing amount to be eligible for a loan |

| Select repayment periods ranging from 12 to 60 months to suit your budget |

Must have a Revolut account to apply and receive funds |

Key Features

Here are the unique features that make the Revolut app the best Earnin substitute apps for smart saving:

Instant Loan Approval

This feature lets you get quick loan approvals directly within the Revolut app. It eliminates the need for lengthy bank visits or paperwork.

Transparent Interest Rates

It offers clear and upfront interest rates with no hidden fees, so you can always know exactly what you’ll pay.

Direct Account Deposit

The approved funds are deposited straight into your Revolut account, giving you immediate access to the money.

Smart Notifications

This feature helps you receive alerts for upcoming payments, due dates, and remaining balances to avoid missed payments.

Credit Score Friendly

It helps you build or improve your credit profile by reporting on-time payments to relevant credit bureaus.

10. Current

Google Play Store Rating: 4.5/5

Current is a fast-growing neobank that helps users manage finances on the go. It is ideal if you’re already in the Current ecosystem and prefer managing your finances in one place. You can access up to $750 as an advance on your next paycheck, depending on eligibility.

Also, qualifications don’t rely on credit scores. It is based on your account activity and direct deposit history.

| Pros |

Cons |

| No monthly maintenance charges, no overdraft fees, and no minimum balance requirements |

The high interest rate maxes out at $6,000 across all saving pods |

| Earn up to 4% APY on savings pods, although the total earning cap is $6,000 |

ATM withdrawals or transactions abroad could incur fees |

| Direct deposits arrive early, sometimes as much as two days ahead of payday |

Users cannot hold more than $10,000 in their Current account |

Key Features

Here are the built-in features that make the Current one of the popular companies like Earnin:

Instant Loan Approval

This feature allows instant loan approval for eligible users, giving you quick funds without lengthy waiting times.

Direct Account Deposit

With the direct account deposit feature, approved loan amounts are sent straight to your Current account.

Early Repayment Option

Current allows users to repay their loans ahead of schedule without any hidden penalties or extra fees.

Smart Notifications

Stay on top of your loans with smart notifications that remind you of upcoming due dates, payment confirmations, and account activity.

Credit Score Friendly

The current loan app is credit score-friendly, meaning small, short-term loans and timely repayments can help build or maintain your credit score.

Requires

Android 8.0, iOS 16.0

Size

78 MB Android, 159 MB iOS

11. Payactiv

Google Play Store Rating: 5.0/5

Apple Store Rating: 4.9/5

Payactiv is a pioneering Earned Wage Access (EWA) platform that enables employees to access a portion of their earned wages before payday. Trusted by over 2 million users and integrated with more than 1,500 employers, it offers a modern, employer-sponsored alternative to payday loans.

The app also integrates tools for budgeting, bill payment, and savings, making it more than just a paycheck advance service.

| Pros |

Cons |

| Funds can easily be sent directly to your bank account or Payactiv Visa card |

Availability depends on employer participation |

| Pay bills directly from the app and use built-in budgeting and saving features |

Access is limited to a portion of earned wages |

| Access funds without affecting your credit score |

Small service fees for instant transfers |

Key Features

The following key features are present in the Payactiv app that make financial management simple:

Bill Payment Integration

This feature helps you pay bills directly through the app, reducing the risk of late fees and missed payments.

Smart Spending Insights

Payactiv helps you get personalized budgeting tips and real-time spending insights to improve your financial habits.

Savings Goal Tracker

The app allows users to set and track saving goals directly in the app to build a financial safety net.

No Credit Check Loans

You can easily access small, short-term advances without impacting your credit score.

Requires

Android 10 or up, iOS 13.0 or up

Size

47 MB Android, 57 MB iOS

12. Cleo

Google Play Store Rating: 4.2/5

Apple Store Rating: 4.6/5

Cleo is an AI-powered financial assistant app similar to Earnin that provides users with short-term cash advances and money management tools on one platform. Through its Cleo Cover service, users can access $250 in interest-free cash advances to handle urgent expenses, avoid overdraft fees, or bridge the gap until their next paycheck.

It is popular among Gen Z and millennials, and gives a fast, accessible alternative to traditional payday loans.

| Pros |

Cons |

| Get up to $250 instantly with no interest or late fees |

Cash advance limit starts small for new users |

| Fun, interactive AI chatbot that makes managing money engaging |

A small optional tip or subscription fee may apply |

| Get budgeting, savings, and spending insights in one app |

Requires linking your bank account for eligibility |

Key Features

The Cleo platform comes with the following key features that help in the overall money management:

Instant Cash Advance

The app allows you to borrow up to $250 instantly, with no credit check and no interest, helping you cover emergencies between paychecks.

AI Chatbot Support

Cleo’s witty and interactive chatbot offers financial advice, spending breakdowns, and budgeting tips in a conversational style.

Budgeting and Spending Insights

This feature tracks your spending habits with personalized insights and recommendations to stay on top of your finances.

Savings Challenges

You can join savings challenges and set automated goals. This turns saving money into a fun, gamified experience.

Requires

Android 7.0 and up, iOS 14.0 or up

Size

159 MB Android, 139 MB iOS

13. Klover

Google Play Store Rating: 4.6/5

Apple Store Rating: 4.7/5

Klover is a cash advance app that lets users borrow up to $200 with no interest and no credit check. It can earn revenue through optional tips and by using anonymized consumer data for partnered market research. This approach allows users to access quick funds without hidden costs.

If you need funds for an emergency bill or want to improve your budgeting habits, Klover aims to be both your financial safety net and money coach.

| Pros |

Cons |

| Get up to $200 with no interest and no mandatory fees |

Limited to users with a regular income and a linked bank account |

| Quick application and approval process |

The data-sharing model may not be preferable for privacy-conscious users |

| Includes budgeting tools and credit score monitoring |

|

Key Features

Looking for apps better than Earnin? These are the following features you’ll access when using the Klover app:

Credit Score Monitoring

This feature tracks your credit score within the app and provides tips to help improve your financial profile over time.

Budgeting and Spending Insights

The app automatically categorizes your spending and gets easy-to-read breakdowns to help you identify where your money is going.

Data-for-Value Program

You can share anonymised consumer data for market research, allowing you to access funds for free.

Personalized Financial Offers

This helps you receive curated offers for credit cards, savings accounts, and other financial products that match your profile.

Goal-Based Saving Tools

You can set short-term and long-term financial goals and track your progress directly within the app.

Requires

Android 7.0 or up, iOS 16.0 or up

Size

161 MB Android, 168 MB iOS

14. DailyPay

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.8/5

DailyPay is an Earned Wage Access (EWA) platform that allows employees to access their earned income before payday. Instead of waiting for the traditional paycheck cycle, users can transfer the money they’ve already earned directly to their bank account, prepaid card, or debit card.

DailyPay partners with thousands of employers across the U.S., making it an accessible and employer-backed alternative to payday loans.

| Pros |

Cons |

| Partnered with 8,000 employers for seamless integration |

Only available if your employer is partnered with DailyPay |

| No credit checks or debt involved |

Has a small transfer fee for instant withdrawal ($1.99 – $2.99) |

| Helps avoid overdraft fees and payday loan interest |

Not available to freelancers or gig workers |

Key Features

DailyPay brings the following key functionalities that ensure a smooth and hassle-free money management experience:

Real-Time Pay Tracker

This feature helps you see exactly how much you’ve earned after each shift so you can make informed spending decisions.

Employer-Integrated System

It works directly with your company’s payroll and time-tracking systems for accurate payouts.

Scheduled Payday Deposits

If you don’t make an early transfer, your wages are automatically deposited on your regular payday.

Shift-by-Shift Breakdown

You can view your earnings by shift or day, including taxes and deductions, for complete transparency.

Transaction History and Reports

This feature helps you access detailed records of withdrawals and deposits to track your usage and spending habits.

Requires

Android 9 and up, iOS 14.0 or up

Size

94 MB Android, 94 MB iOS

15. Possible

Google Play Store Rating: 4.0/5

Apple Store Rating: 4.8/5

Possible Finance is a mobile-based lending platform that offers small-dollar loans up to $500. It is known to be more flexible and affordable than traditional payday loans. Instead of requiring full repayment on your next paycheck, Possible allows you to repay the loan in multiple installments over several weeks, helping reduce financial strain.

The app is available in select U.S. states and uses bank account and income history to determine eligibility, making it accessible to people with limited or poor credit histories.

| Pros |

Cons |

| Repay in multiple installments rather than all at once |

Only available in certain U.S. states |

| Build your credit history with on-time payments |

Interest rates are higher than traditional personal loans |

| Fast approval process with same-day or next-day funding |

Requires linking your bank account for eligibility |

Key Features

If you’re looking for apps to borrow paycheck early, Possible is a great option. With this app, you’ll discover the following features that help you meet your financial goals:

Installment Repayments

This feature spreads your repayments over four biweekly or semi-monthly installments to make repayment more manageable.

Credit Building

On-time repayments are reported to credit bureaus, helping you improve your credit score over time.

Transparent Fee Structure

Fixed fees are disclosed upfront, with no prepayment penalties or additional charges.

Mobile-First Experience

This feature lets you apply, get approved, track your loan balance, and make payments directly from the mobile app.

Requires

Android 11 and up, iOS 15.0 or up

Size

43 MB Android, 71 MB iOS

16. Avant

Google Play Store Rating: 4.7/5

Apple Store Rating: 4.8/5

Avant is one of Earnin competitors that offers unsecured loans through its mobile app, making it easy for borrowers to apply, track, and manage their loans on the go. Loan amounts typically range from $2,000 to $35,000 with flexible repayment terms.

Avant caters to borrowers with fair to good credit, providing a middle ground between high-interest payday loans and low-rate prime lending.

| Pros |

Cons |

| No collateral required for loans |

Origination fees may apply (up to 4.75% of the loan amount) |

| Fast approval process with potential next-day funding |

APRs can be high for borrowers with lower credit scores (up to 35.99%) |

| Flexible repayment terms of 12 to 60 months |

Not available in all U.S. states |

Key Features

These are the following core functionalities that are integrated into the Avant app:

Personal Loan without Collateral

Unsecured loans can be used for debt consolidation, medical bills, home improvements, or other personal expenses.

Autopay and Payment Reminders

This feature allows you to set up automatic payments or receive reminders to avoid late fees and maintain a positive payment history.

Soft Credit Check for Prequalification

It helps you check potential rates and terms without impacting your credit score.

Credit Reporting

Payment history is reported to major credit bureaus, which can help improve your credit score with consistent on-time payments.

Security and Privacy

The app uses bank-level encryption and multi-factor authentication for safe account management.

Requires

Android 6.0 and up, iOS 11.0 and later

Size

37.9 MB Android, 165.6 MB iOS

17. Upstart

Apple Store Rating: 3.0/5

Upstart is one of the Earnin alternatives that offers personal loans ranging from $1,000 to $50,000, using advanced algorithms to assess creditworthiness beyond traditional credit scores. The platform considers factors like education, employment history, and income potential, making it accessible to borrowers with limited or average credit histories.

Through the Upstart mobile app, users can quickly apply for a loan, check rates with a soft credit inquiry, and manage payments, all from their phone. Upstart is known for its fast approval process, transparent terms, and flexible loan uses, including debt consolidation, medical expenses, home improvement, and more.

| Pros |

Cons |

| Borrow from $1,000 to $50,000 for a variety of personal needs |

Origination fees up to 12% of the loan amount |

| Considers non-traditional factors like education and job history |

Higher APRs for borrowers with lower credit scores |

| Soft credit check for prequalification |

Limited repayment term options (typically 36 or 60 months) |

Key Features

Here are some of the best features Upstart offers to make money management easier:

AI-Driven Loan Approval

It uses machine learning models to assess eligibility, potentially approving borrowers overlooked by traditional lenders.

Fast Funding

Many approved applicants receive funds as soon as the next business day after acceptance.

Multiple Loan Uses

Loans can be used for debt consolidation, credit card payoff, medical bills, moving expenses, or home projects.

Credit Reporting

Payment history is reported to major credit bureaus, helping responsible borrowers improve their credit scores.

Requires

iOS 16.0 and later

18. One@Work

Google Play Store Rating: 4.8/5

Apple Store Rating: 4.9/5

One@Work is an innovative cash advance and earned wage access (EWA) app developed by One Finance. It enables employees to access a portion of their earned wages before payday, helping them avoid high-interest payday loans or costly credit card debt.

It aims to boost financial well-being and reduce financial stress for workers. The platform integrates directly with employers, ensuring accurate wage tracking and fast payouts.

| Pros |

Cons |

| Employer integration ensures accuracy and speed |

Only available through participating employers |

| Helps reduce reliance on payday loans and credit cards |

May charge small fees for instant transfers |

| No credit check needed |

Limited to wages already earned in the current pay cycle |

Key Features

Below are the major functionalities that you’ll find in the One@Work app:

Employer-Integrated System

This feature works directly with your employer’s payroll for secure and accurate wage calculations.

No Credit Impact

It helps you access funds without a credit check, as you’re borrowing against your own earned income.

Flexible Transfer Options

You can choose instant transfers (with a small fee) or free scheduled deposits.

Financial Well-Being Focus

The app is designed to reduce dependence on costly payday loans or high-interest credit cards.

Real-Time Earning Tracking

You can monitor your available earned wages throughout the pay cycle.

Requires

Android 5.0 and up, iOS 13.4 or up

Size

57 MB Android, 85 MB iOS

19. CashApp

Google Play Store Rating: 4.2/5

Apple Store Rating: 4.8/5

Cash App is a popular mobile payment platform developed by Block, Inc. (formerly Square). It offers a Cash App borrow feature that allows eligible users to take out small, short-term loans directly through the app. Loan amounts typically range from $20 to $200, making it a quick solution for covering small, unexpected expenses without resorting to high-interest payday loans.

The feature is currently available only to select users based on factors such as account activity, deposit history, and credit standing.

| Pros |

Cons |

| Flat fee structure makes repayment costs predictable |

Not available to all users |

| Fast approval and instant deposit to your Cash App balance |

Small loan limits may not cover larger emergencies |

| No need for a separate loan application or credit check for many users |

Requires an active Cash App account |

Key Features

Cash App comes with the following tools that help users save, invest, and manage money:

Flat Fee Repayment

Instead of interest, a single fixed fee is charged, making it easier to budget repayments.

Automatic Repayments

Payments are automatically deducted from your Cash App balance or linked payment method to avoid missed due dates.

Eligibility-Based Access

It is available to selected users based on account activity, deposit patterns, and payment history.

In-App Loan Management

This feature views the remaining balance, payment schedule, and upcoming due dates directly from Cash App.

Requires

7.0 and Up (Android) 15.0 and Later (iOS)

Size

88.1 MB (Android) 301.1 MB (iOS)

20. FloatMe

Google Play Store Rating: 4.5/5

Apple Store Rating: 4.8/5

FloatMe is a mobile-based cash advance app that helps users bridge small gaps between paydays by offering short-term cash “Floats”, advances of typically $10 to $50, without interest or credit checks.

It operates under a subscription model, giving members fast access to small funds while including smart budgeting tools to improve financial clarity.

| Pros |

Cons |

| Interest-free and doesn’t impact your credit score |

Subscription fee ($4.99 /month) may be high for some people |

| Funds may arrive within minutes |

Not available in Connecticut, D.C., or Nevada |

| Relies on income and banking history for eligibility |

|

Key Features

Here are some key features that make FloatMe a reliable partner in managing money:

Cash Flow Calendar and Budget Tools

This feature forecasts upcoming income vs. expenses to plan floats strategically. It also includes low balance alerts to prevent overdraft fees.

Bank Integration via Plaid

It securely connects to thousands of U.S. banks for both advance and repayment processing.

Repayment Automation

Advances are typically repaid automatically on the next paycheck via ACH or debit card.

Optional Instant Float

You can receive expedited funding within minutes for a fee ranging from $1 to $7, depending on the amount and delivery method.

Requires

Android 7.0 and up, iOS 14.0 or up

Size

83 MB Android, 86 MB iOS

21. Affirm

Google Play Store Rating: 4.8/5

Apple Store Rating: 4.9/5

Affirm is a buy now, pay later (BNPL) app and payment platform that allows users to split purchases into smaller, fixed monthly payments or interest-free installments at participating merchants. It requires no hidden fees, and users see the total payment amount upfront before committing.

Affirm conducts a soft credit check for eligibility but doesn’t charge late fees, making it a transparent alternative to traditional credit cards.

| Pros |

Cons |

| Loan amount ranges from $50 to $17,500 |

Interest rate can be high for some purchases (up to 36% APR) |

| Can offer 0% APR at select merchants |

May encourage overspending if not budgeted properly |

| Wide network of retail partners online and in-store |

Missed payment can hurt your credit score |

Key Features

Now, take a look at the major functionalities that make the Affirm app the most popular platform:

Upfront Cost Transparency

Before you buy, Affirm shows you exactly how much you’ll pay in total, including interest, so there are no surprises.

Instant Credit Decision

At checkout, Affirm runs a quick, soft credit check that does not affect your credit score to determine eligibility and payment options.

Flexible Payment Plans

You can choose between short-term (biweekly or 3-month) interest-free plans, select merchants, or longer-term financing up to 36 months with interest.

Secure Transactions

Affirm uses bank-level encryption and security to protect personal and financial data.

Requires

Android 7.1, iOS 12.0 or higher

22. Wealthfront

Google Play Store Rating: 4.0/5

Apple Store Rating: 4.8/5

Wealthfront is a borrowing option offered to Wealthfront investing clients, allowing them to access funds without selling investments. Instead of liquidating assets and potentially triggering taxes, users can borrow up to a set percentage of their portfolio’s value at competitive interest rates.

This feature is built into Wealthfront’s broader automated investing platform and requires no credit check, since approval is based on account holdings.

| Pros |

Cons |

| Lower interest rates than most personal loans or credit cards |

Only available to Wealthfront investing clients with at least $25,000 invested |

| Flexible repayment with no set schedule |

Loan amount tied to market performance if the portfolio value drops, the borrowing limit may decrease |

| Borrow up to 30% of your taxable investment account balance |

Not ideal for those without investment accounts |

Key Features

Wealthfront is packed with features that help you save more and spend smarter:

Low, Transparent Rates

Interest rates typically range from 5%-8% APR (variable), lower than average credit card rates, and are clearly disclosed before you borrow.

Flexible Repayment

There’s no fixed repayment schedule; you can repay at your own pace. Interest accrues until the balance is cleared.

Market-Based Limits

Your borrowing capacity updates in real-time with changes in your investment portfolio’s value.

Seamless Integration with Wealthfront

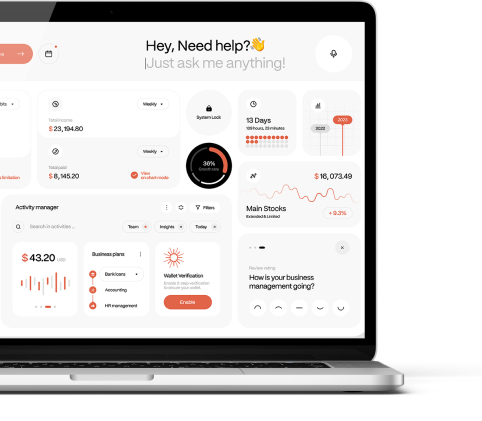

You can manage investments, loans, and repayments all in one dashboard via the Wealthfront mobile app or desktop platform.

Requires

Android 10 and up, iOS 16.0 and later

Size

102 MB Android, 203 MB iOS

23. Cashli

Google Play Store Rating: 3.6/5

Cashli is a U.S.-based mobile cash advance app that offers short-term, interest-free advances, typically ranging from $10 to $150, to help users bridge cash gaps without requiring credit checks. It operates under a fixed monthly subscription and integrates smart financial tools to improve awareness and prevent overdraft fees.

| Pros |

Cons |

| Interest-free advances with no credit check or SSN/ITIN requirement |

Not all users qualify immediately |

| No late or hidden fees |

Doesn’t support some online banks (e.g., Chime, Varo) |

| Standard delivery within 2-3 business days |

Reports of bank-level issues and poor customer experiences |

Key Features

Here’s a look at the tools and functionalities that make Cashli a complete financial assistant:

Bank Integration and Security

It securely connects to thousands of U.S. banks via Plaid, ensuring encrypted access without storing credentials.

Adaptive Borrowing Limit

New users may start with smaller amounts ($20-$40), but the amount can grow with consistent usage and repayment.

Financial Insight Tools

In-app features include low-balance alerts and transaction summaries, with plans to introduce proactive alerts for changing spending habits.

Mission-Driven Design

Cashli targets Americans with limited savings, often under $400, to curb reliance on overdraft fees and high-interest payments.

Requires

Android 8.0 and up

24. Strix

Google Play Store Rating: 4.2/5

Apple Store Rating: 3.7/5

Strix is a personal loan and payday advance platform packaged as a mobile app by Borrow Money LLC. While marketed as a quick cash advance solution, Strix actually functions as a loan aggregator, connecting users to licensed third-party lenders who determine loan terms, interest rates, and repayment schedules.

It’s designed for borrowers who need fee-free payday access but may not want to go through a traditional bank application process.

| Pros |

Cons |

| Quick access to multiple lending offers in one place |

APR can be high (5.99% – 35.99%) |

| Secure encryption for data protection |

Terms, fees, and eligibility vary widely by lender, reducing predictability |

| No hard credit check for browsing offers |

Technical issues reported, including freezes and slow response times |

Key Features

Check out the following functionalities that make Strix a standout app:

Loan Matching Network

Strix connects users with a network of licensed lenders across the U.S., allowing borrowers to compare offers in one app instead of applying to each lender separately.

Instant Loan Decisions

Once you complete the application form, lending partners provide near-instant decisions on eligibility and loan terms.

Wide Loan Amount Range

You can borrow as little as much as $5,000+, with repayment terms from 3 to 36 months. This flexibility caters to both short-term and larger expenses.

Secure Data Encryption

Bank-level encryption protects all user data submitted through the app, reducing the risk of identity theft.

Requires

Android 4.4 and up

25. Beem

Google Play Store Rating: 4.0/5

Apple Store Rating: 4.7/5

Beem (formerly Line) is a U.S.-based mobile-forward financial app branded as “Better than Cash Advance.” It offers users early access to their own verified deposits through a feature called Everdraft, ranging from $10 to $1,000, without interest, credit checks, or fixed repayment deadlines.

With a low monthly subscription, Beem also integrates tools for financial insights, tax filing, and peer-to-peer transfers.

| Pros |

Cons |

| Interest-free access to your own deposited money |

Doesn’t work as a traditional loan |

| Low-cost subscription (starting around $0.99- $2.47 / month) |

Reports of app crashes, login issues, and delayed withdrawals |

| Up to five family or friends can be added under one subscription plan |

Only available to US-based users |

Key Features

Discover the powerful features of Beem that turn financial complications into simple steps:

Budgeting and Financial Insights

Beem includes a smart financial feed, tracking spending, alerting users to low balances, and helping them stay ahead of bills and potential overdrafts.

Tax Filing Integration

Users can file federal and state taxes directly through Beem, helping to streamline tax season and potentially maximize refunds.

Peer Transfers and Social Tools

You can send money quickly to anyone, even without a bank account. Beem supports group splits and scheduling, making shared expenses easier to manage.

Security and Support

The app is built with bank-level encryption and provides 24/7 support via chat, email, and phone. All sensitive data is protected in accordance with high privacy standards.

Requires

Android 7.0 or up, iOS 12.4 or up

Size

74 MB Android , 72 MB iOS

Build Apps Similar to Earnin Today!

If you’re tired of living paycheck to paycheck or dreading unexpected expenses, apps like Earnin offer a practical way to stay afloat without falling into debt traps. These apps empower users with early wage access, fewer fees, and more control over their financial lives. Although they’re not a long-term solution for bigger money challenges, they can definitely be a helpful buffer when times get tough. Just make sure to use them wisely and always read the fine print.

Are you planning to build a loan app in the USA? Trango Tech is well-versed in building apps that help you meet long-term business goals.

Frequently Asked Questions

Q. Are there any other apps similar to Earnin?

If you like the idea of getting paid before payday but want to explore your options, there are numerous apps like Earnin that offer similar features. For example, MoneyLion lets you borrow up to $500 with no interest or credit checks. Brigit is another great option, which comes with budget tracking and overdraft protection, though it does charge a monthly fee. Then, there’s Dave, which gives you small cash advances and even a checking account with early pay features.

Each app has its own perks, so it’s worth checking out what fits best with your income schedule and financial habits. Be sure to look into the fees, transfer speeds, and eligibility requirements before signing up.

Q. What app will offer a loan immediately?

Apps like Earnin, MoneyLion, Dave, and Brigit are among the top options that can offer instant or same-day cash advances. Most of these apps allow you to access funds quickly, especially when you opt for their express transfer feature. For example, Dave offers fast cash advances with their “Express” option.

You need to keep in mind that while funding can be immediate, eligibility depends on factors like your income, bank account activity, and repayment history.

Q. Where can I borrow $200 instantly?

You can borrow money through apps like Earnin mentioned in this blog. Dave offers an “ExtraCash” advance of up to $500, and Brigit can send funds instantly depending on your account history.

Most of these apps offer instant funding only if you choose their express delivery option, which might include a small fee. Otherwise, standard delivery is usually free but takes 1-2 business days to arrive. Always check the fine print so you know exactly what to expect.

Q. What is the reason for getting rejected for a $1000 loan with no credit?

Even if a lender doesn’t check your credit score, getting approved for a $1000 loan isn’t guaranteed. These apps and lenders often look at other factors like your income, bank account activity, spending habits, and how long you’ve had a stable deposit history.

If you don’t have consistent direct deposits, have frequent overdrafts, or your income seems too low or irregular, you might get denied. Some platforms also limit the amount you can borrow initially, starting small and gradually increasing your limit as you build trust. So, if you were turned down, it doesn’t necessarily mean you’re ineligible forever, it means you may need to build up some account history first or try a lower loan amount to start.

Q. Is Earnin safe or legit?

EarnIn has been around for more than a decade (originally called Activehours), is based in Palo Alto, and partners with FDIC-insured Evolve Bank and Trust. This makes it officially legitimate and not a scam.

When it comes to data safety, Earnin uses industry-standard safeguards, including 256-bit encryption, firewalls, and strict data protection protocols, and states that it doesn’t sell your information.

Q. Can Earnin alternatives impact badly on my credit or get a person into debt?

Apps like Earnin don’t directly affect your credit score, don’t perform hard credit checks, and don’t report to credit bureaus. So in that sense, using them won’t hurt your credit. However, while they may seem low-risk on the surface, it’s still essential to use them responsibly.

Although sites like Earnin don’t charge interest, they can create a cycle of dependency if you rely on them regularly. Borrowing from your next paycheck over and over can make it harder to cover future expenses, especially if you’re not budgeting for repayments. Plus, express fees and tipping (which are optional but encouraged) can add up, making the service more expensive than it first appears.

Q. Do companies like Earnin charge interest or fees?

Most apps like Earnin do not charge traditional interest rates like banks or payday lenders. They often use a voluntary tip model, where you can choose to pay a small tip (often $1–$14) to support the service. Some apps also offer subscription plans for additional features, such as higher advance limits or faster transfers.

While standard transfers are usually free, instant transfers may come with a small fee, depending on the amount and delivery method. These alternatives make the service more affordable than payday loans, but it’s still important to track how much you’re tipping or paying in fees over time, as small amounts can add up.